Practice Update - 2 March 2021

Ian Campbell • 12 May 2021

Changes to STP reporting concessions from 1 July 2021

Small employers (19 or fewer employees) are currently exempt from reporting ‘closely held’ payees through Single Touch Payroll ('STP'). Also, a quarterly STP reporting option applies to micro employers (four or fewer employees). These concessions will end on 30 June 2021.

The STP reporting changes that apply for these employers from 1 July 2021 are outlined below.

Closely held payees (small employers)

From 1 July 2021, small employers must report payments made to closely held payees through STP using any of the options below. Other employees must continue to be reported by each pay day.

A ‘closely held payee’ is an individual who is directly related to the entity from which they receive payments. For example, this could include family members of a family business, directors or shareholders of a company and beneficiaries of a trust.

Payments to such payees can be reported via STP (from 1 July 2021) using any of the following options:

1. Report actual payments on or before the date of payment.2. Report actual payments quarterly on or before the due date for the employer’s quarterly activity statements.3. Report a reasonable estimate quarterly on or before the due date for the employer’s quarterly activity statements. Note that consequences may apply for employers that under-estimate amounts reported for closely held payees.

Small employers with only closely held payees have up until the due date of the payee’s tax return to make a finalisation declaration. Employers will need to speak with these payees about when their individual income tax return is due.

Micro employers

From 1 July 2021, the quarterly reporting concession will only be considered for eligible micro employers experiencing ‘exceptional circumstances’.

Common examples of when the ATO would generally consider it to be fair and reasonable to grant a deferral due to exceptional or unforeseen circumstances include natural disasters, other disasters or events, serious illness or death.

Additionally, ‘exceptional circumstances’ for access to the STP quarterly reporting concession from 1 July 2021 may include where a micro employer has:

seasonal or intermittent workers; or no or unreliable internet connection.

The ATO says it will consider any other unique circumstances on a case-by-case basis.

It should be noted that registered agents must apply for this concession and lodge STP reports, quarterly, on behalf of their eligible micro employer clients.

The STP reports are due the same day as the employer’s quarterly activity statements.

If an employer prefers to report monthly, the STP reports must be lodged on or before the 21st day of the following month.

Finalisation declarations will need to be submitted by 14 July each year.

Editor: Please contact our office if you require more information or assistance with these STP reporting options.

Paper PAYG and GST quarterly instalment notices

The ATO has previously advised that it will no longer issue paper activity statements after electronic lodgment. Instead, electronic activity statements will be available for access online, three to four days after the activity statement is generated.

As part of its digital improvement program, the ATO stopped issuing paper quarterly PAYG and GST instalment notices (forms R, S & T), where taxpayers had a digital preference on ATO systems. The September 2020 notice was the last one issued to these taxpayers.

However, the ATO has received feedback from tax professionals that issues have arisen for some of their clients as a result of this change. For example, some taxpayers who are self-lodgers rely on the receipt of the paper statements as a reminder that their instalments are due.

As an interim solution, the ATO said it will issue paper PAYG and GST quarterly instalment notices starting with the March 2021 quarterly notices.

For taxpayers impacted by this change, the ATO will work with their registered agents to take their circumstances into account. The ATO has a range of practical support options available, including lodgment deferrals and payment plans that agents can access online, on behalf of their clients.

For self-lodgers, the ATO has issued an email notification reminding them that their December 2020 PAYG and GST instalment notices are due for payment soon (by 2 March 2021).

The ATO said it will continue to work with the tax profession to develop a digital solution for the PAYG and GST instalment notices that is workable for registered agents and their clients.

Editor: Please contact our office if you require more information about paper PAYG or GST quarterly instalment notices.

Avoiding disqualification from SG amnesty

The superannuation guarantee (‘SG’) amnesty ended on 7 September 2020. Employers who disclosed unpaid SG amounts and qualified for the amnesty are reminded that they must either pay in full any outstanding amounts they owe, or set up a payment plan and meet each ongoing instalment amount so as to avoid being disqualified and losing the benefits of the amnesty.

The ATO will be sending employers reminders to pay disclosed amounts, if they have not previously engaged with the ATO. Employers will have 21 days to avoid being disqualified from the amnesty.

Registered agents can assist their employer clients who qualified for the SG amnesty avoid disqualification. In particular, if a client needs to set up a payment plan, agents can do this (online) on their behalf, if the employer:

has an existing debit amount under $100,000 (total balance or overdue amounts); does not already have a payment plan for that debit amount; and has not defaulted on a payment plan for the relevant account more than twice in the past two years.

The ATO has advised that employers who are disqualified from the amnesty will:

be notified in writing of the quarter they are disqualified for; be charged an administration component of $20 per employee for each disqualified quarter; have their circumstances considered when deciding a Part 7 penalty remission (this is an additional penalty of up to 200% of the unpaid SG amount that may be imposed under the SG laws); and be issued with a notice of amended assessment.

Employers who continue to qualify for the SG amnesty are reminded that they can only claim a tax deduction for amounts paid on or before 7 September 2020 (i.e., the amnesty end date).

Editor: Please contact our office if you require more information or would like us to set up a payment plan for SG amnesty amounts on your behalf.

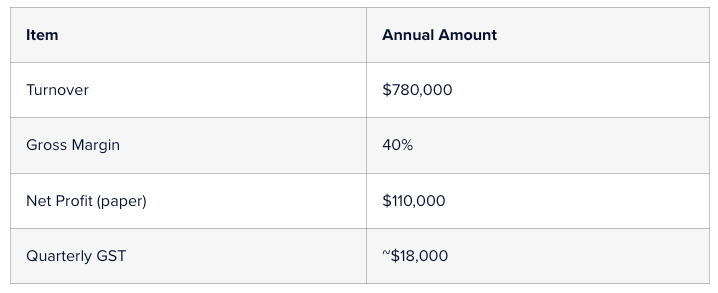

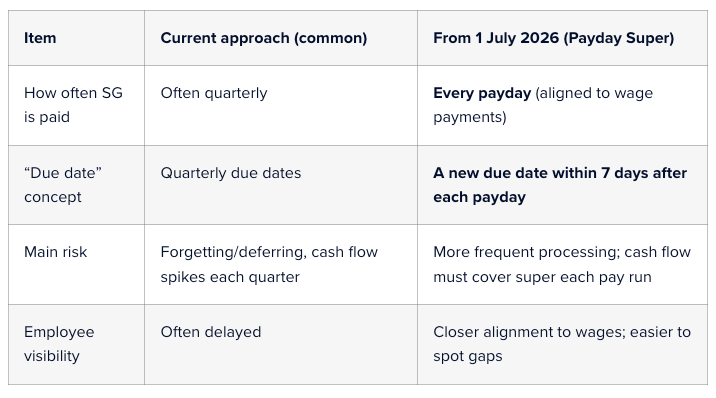

Readiness strategies in preparation for the Payday Super If you run a small business, paying Superannuation can feel like “one more admin job” on top of payroll, BAS and everything else. Two key changes mean Superannuation deserves a fresh look this year: The Super Guarantee (SG) rate is 12% for 1 July 2025 to 30 June 2026 (and remains 12% after that). From 1 July 2026, “Payday Super” starts — employers will be required to pay SG on payday , rather than quarterly, and contributions must be paid into the employee’s fund within 7 days of payday . What does SG at 12% mean in everyday terms? SG is calculated on an employee’s Ordinary Time Earnings (OTE) (often the base rate and ordinary hours, plus certain loadings/allowances depending on how they’re paid). The key point for most businesses is that the Superannuation cost is now 12 cents for every $1 of OTE. If you haven’t already, it’s worth confirming whether your staff packages are “plus super” (super on top) or “inclusive of super” (rare, but it happens). A small misunderstanding here can quietly create underpayments. What is “Payday Super” and why is it changing? Many employers pay the Superannuation Guarantee (SG) quarterly. Payday Super changes the rhythm: From 1 July 2026 , each time you pay OTE to an employee, it creates a new super payment obligation for that payday. You’ll have a 7-day due date for the SG to arrive in the employee’s fund after each payday (this is designed to allow time for payment processing). The ATO is implementing the change, and guidance is already being published to help employers prepare. This reform is aimed at reducing unpaid super and making it easier for workers to see whether super has actually been paid, closer to when they’re paid wages. Quarterly vs payday Super

A real-world case study on trust distributions Mark and Lisa had what most people would describe as a “pretty standard” setup. They ran a successful family business through a discretionary trust. The trust had been in place for years, established when the business was small and cash was tight. Over time, the business grew, profits improved, and the trust started distributing decent amounts of income each year. The tax returns were lodged. Nobody had ever had a problem with the ATO. So naturally, they assumed everything was fine. This is where the story starts to get interesting. Year one: the harmless decision In a good year, the business made about $280,000. It was suggested that some income be distributed to Mark and Lisa’s two adult children, Josh and Emily. Both were over 18, both were studying, and neither earned much income. On paper, it made sense. Josh received $40,000. Emily received $40,000. The rest was split between Mark, Lisa, and a company beneficiary. The tax bill went down. Everyone was happy. But here’s the first quiet detail that mattered later. Josh and Emily never actually received the money. No bank transfer. No separate accounts. No conversations about what they wanted to do with it. The trust kept the funds in its main business account and used them to pay suppliers and reduce debt. At the time, nobody thought twice. “It’s still family money.” “They can access it if they need it.” “We’ll square it up later.” These are very common thoughts. And this is exactly where risk quietly begins. Year two: things get a little more complicated The next year was even better. They used a bucket company to cap tax at the company rate. Again, a common and legitimate strategy when used properly. So the trust distributed $200,000 to the company. No cash moved. It was recorded as an unpaid present entitlement. The idea was that the company would get paid later, when cash flow allowed. Meanwhile, the trust needed funds to buy new equipment and cover a short-term cash squeeze. The trust borrowed money from the company. There was a loan agreement. Interest was charged. Everything looked tidy on paper. From the outside, it all seemed sensible. But economically, nothing really changed. The trust made money. The trust kept using the money. The same people controlled everything. The bucket company never actually used the funds for its own business or investments. This detail becomes important later. Year three: circular money without anyone realising By year three, things had become routine. Distributions were made to the kids again. The bucket company received another entitlement. Loans were adjusted at year-end through journal entries. What is really happening is a circular flow. Money was being allocated to beneficiaries, then effectively coming back to the trust, either because it was never paid out or because it was loaned back almost immediately. No one was trying to hide anything. No one thought they were doing the wrong thing. They were just following what they’d always done. This is how section 100A issues usually arise. Slowly, quietly, and without any single dramatic mistake.