Practice Update June 2019

SMALL BUSINESS ENTITIES

Records are required to be retained for tax purposes for between two and five years, depending on class of taxpayer.

For taxpayers lodging tax returns under the SBE rules, the retention period for records is two years.

However, records must to be retained for the term of ownership for an asset subject to capital gains tax. The ATO does allow taxpayers to use an asset register to record capital gains tax transactions. These entries must be certified by a registered tax agent. There is then no need to retain the supporting records for the period of the investment.

Source records should also generally be retained to substantiate the existence of tax losses, meaning that records should be available to support tax losses incurred more than 5 years ago.

The SBE rules apply to a sole trader, partnership, company or trust which operates a business for all or part of the income year and has an aggregated (i.e. group) turnover of less than $10 million.

Businesses that qualify as SBEs can elect to utilise simplified depreciation rules as follows:

- A small business taxpayer can immediately write off the cost of assets, including motor vehicles, costing up to $30,000. This incentive has been extended to 30 June 2020. This incentive has changed since this financial year.

| Date | Threshold |

| 1.7.2018 – 18.1.2019 | $20,000 |

| 19.1.2019 – 2.4.2019 | $25,000 |

| 2.4.2019 – 30.06.2020 | $30,000 |

- Depreciable assets costing more than $30,000 may be added to a small business pool and depreciated at 15% in the year of purchase – regardless of the date of purchase and 30% in subsequent years.

- Where the purchaser is registered for GST, the cost of the asset is exclusive of GST. However, where the purchaser is not registered for GST, then the cost of the asset is inclusive of GST. For example, a CGT registered business eligible to utilise the SBE rules can purchase a car for up to $33,000 GST inclusive and immediately write off the cost of the asset in the year of purchase.

SBE’s in the 2019 year, may also take advantage of the following concessions:

- Simplified trading stock rules apply so that the taxpayer does not have to account for changes in trading stock or complete a stock take for tax purposes where the difference between the value of the original opening stock and a reasonable estimate of the closing stock is $5,000 or less.

- An immediate deduction for certain prepaid expenses where the goods or services will be provided within 12 months from the date of expenditure. The taxpayer should have a commercial reason for making the prepayment and always consider the affect the prepayment may have on your cashflow.

- Small business started in the 2019 year will be able to claim in immediate deduction for its start-up coats, such as legal, accountancy, cost of constitution or deed, where those costs are incurred in the 2019 year.

Interest on investment loans

With the lender’s approval, taxpayers who have borrowed money for investments or business activities may be able to prepay up to 12 months of interest, with a tax deduction available for that prepaid interest.

There usually needs to be a commercially justifiable reason for making the prepayment,

Prepaying interest for investment loans on rental properties and margin loans on shares, may allow for a tax deduction to be brought forward to the year it is prepaid.

Bad debts

Taxpayers should review their debtors listing to determine if any debts are bad debts. The debt must be written off as uncollectable prior to 30 June.

The bad debt must have previously been brought to account as assessable income and you must ensure you retain the documentation to evidence all recovery attempts made.

To claim a tax loss for a bad debt, taxpayers must also satisfy ordinary loss recoupment rules.

Staff — Leave

Provisions for annual leave and long service leave are not deductible. The deduction is only available when the annual leave is paid.

Where practical, encourage staff to take holidays prior to 30 June.

Staff — Bonus

A bonus may be deductible in the 2019 year if it is quantified, approved and committed to payment prior to 30 June (even if paid after 1 July).

Determine whether any bonuses are to be paid and, if so, ensure the amount is quantified and approve by Directors’. The relevant staff should be notified of the bonus prior to 30 June and that any PAYG Withholding Tax is remitted in the first activity statement after 30 June.

Obsolete plant, fittings and equipment

Review your asset register to identify items that are no longer in use to claim a deduction for the written down value of that item. For 30 June 2019 consider written off your entire small business pool if it is less than $30,000.

Repairs and maintenance

A deduction for repairs and maintenance expenditure is available for work completed by 30 June and is related to the genuine repair and restoration of an existing asset as opposed to purchase of a new asset.

You may wish to bring forward, prior to 30 June, major maintenance expenditure that was scheduled for early in the next financial year.

Entertainment

Entertainment is not deductible unless it is provided as a fringe benefit and Fringe Benefits Tax (“FBTâ€) has been paid.

Unless a log of the expenditure is kept, 50% of expenditure is attributed to employees and subject to FBT and the remaining 50% is attributed to non-deductible client entertainment. GST input credits are not available for entertainment expenses where no FBT has been paid on them.

Directors’ fee

A company paying directors’ fees, should conduct a shareholders’ meetings before 30 June to approve directors’ fees and ensure payment for directors’ fees are drawn prior to 30 June and that PAYG Withholding Tax is deducted from the amount paid to the directors.

Borrowing costs

Review loan documents to ascertain the total borrowing costs on business loans. Borrowing costs can be claimed over the shorter of five years or the term of the loan.

Expense substantiation

Ensure that you can justify all employment related expense amounts incurred and the reason for the expenditure being incurred (for individual items costing less than $10 which total less than $200 for a year, you can claim these expenses with diary records to support the claim rather than receipts.)

Depreciation and residential rental properties

The claim for depreciation will be restricted for residential rental properties contracted to be purchased after 9 May 2017. Depreciation will not be available for second-hand or used depreciating assets, whether purchased with the property or separately after that date.

Property owner’s deductions

Property owners can claim normal expenses against rental income including rates, land tax, advertising for tenants, body corporate fees, insurance, maintenance, interest paid and other recurrent expenses.

However, from 1.7.2017 travel expenses including travel to attend to repairs or property inspection are not deductible to the taxpayer.

Claims for expenses on rental properties is now being closely monitored by the ATO.

Capital works deductions

The construction costs of income producing buildings may be able to be written off at 2.5% or 4% per year, depending on the date of the construction and use of the property.

A review should be undertaken to ensure that all eligible building write-offs are being claimed. If a building has been acquired during the year, details of the original cost of the building and the date of acquisition should be recorded so that the correct amount of building write-off can be claimed.

It is recommended that a quantity surveyor report is obtained to ensure that your eligible capital works and other depreciation claims have been correctly calculation and maximised.

Salary packages

Ensure that salary packages for 2019/2020 that include fringe benefits and/or employer’s superannuation contributions are negotiated and documented prior to payment of the salary.

Motor vehicle expenses

There are two alternate methods available to calculate tax deductions for work related motor vehicle expenses.

There are:

- Cents per kilometre method – a set 67 cents per business kilometre; and

- Logbook method – you calculate your actual business kilometres as a percentage of the total kilometres that the motor vehicle has travelled (established via a logbook) to determine the business percentage which can then be applied to the total motor vehicle expenses.

The cents per kilometre method is only available where business use is 5,000kms or less. Ensure appropriate records and substantiation are maintained to support your claim.

Donations and gifts

Should you intend to make a tax-deductible gift or donation, then you should ensure that the payment is made on or before 30 June.

Check on the ABR website that the charity or recipient is an ATO endorsed deductible gift recipient. A deduction will not be allowable if the donor receives some benefit (e.g. raffle tickets), unless given at an eligible fund-raising event.

For the year ending 30 June 2019 the maximum concessional superannuation contribution is $25,000 (which includes superannuation guarantee paid for by an employer, personal contributions and salary sacrificed amounts) for individual aged up to 75 years.

Where you are over 65 years of age, you can only make a personal concessional contribution where you satisfy the work test.

Defer assessable income

The ability of a taxpayer to defer income will depend on the taxpayer’s business and the type of income derived.

After carefully reviewing interim financial accounts, consider that rather than accelerating your revenue and deferring costs, your business may be better served by doing the opposite in the final quarter.

Medium sized businesses (MSBs)

MSBs – broadly businesses with aggregated turnovers of more than $10m but less than $50m can potentially qualify for a $30k instant asset write-off in the 2019- or 2020-income tax year.

Deceased Estates

Simply dividing on estate between children may overlook tax planning opportunities. Some beneficiaries may wish to receive ASX listed shares in specie – not cash and in so doing defer the CGT event. Testamentary Trusts should be considered for at risk or vulnerable beneficiaries.

Defer Income

It may be possible to defer one off payments, such as bonafide redundancy packages and bonuses into the next tax year. This may be negotiated with your employer.

Directors’ Fees

Directors’ fees are deductible to a company when incurred.

If prior to the year end a resolution is passed at a director’s meeting to pay reasonable directors’ fees and bonuses, then the company has a legal obligation to make the payments, and the amounts determined are tax deductible as at the date of the resolution. They are not assessable to the employee until paid, which usually takes place in the following year. At this time, PAYG should be deducted.

Effectively, a deferral of tax has occurred in the book of accounts. The liability should be shown as “Directors Fees Payableâ€. If credited to a Director’s personal loan account, then under constructive receipt the director is assessable on the income.

Note that on 2 nd June 2011 the ATO issued taxpayers alert 2011/4 on this subject. Make sure you are within the ATO’s guidelines.

Discretionary Trusts– Streaming Income

Streaming income and capital gains to particular beneficiaries can significantly reduce your family tax burden.

Where a discretionary trust derives substantial income and capital profits, identifying the tax profiles of the beneficiaries and making distributions accordingly can result in significantly less tax. Where the individual beneficiaries are on marginal tax rates in excess of the corporate tax rate (currently 30%), distribution of income to a corporate beneficiary can produce a ‘tax deferral’ advantage. Alternatively, where a trustee makes capital gains, distributing them to individual beneficiaries may effectively reduce tax to 23.5% or less.

Home Office Expenses

If carrying on a home-based business, you may claim office expenses as long as the work area is separate and distinct.

Deductible items include heating, lighting, depreciation of furniture and equipment and cleaning .

The percentage apportionment is normally done on floor space. Think carefully before claiming council rates and mortgage interest as this will trigger partial Capital Gains Tax if the property is sold.

Avoid making ambit claims which cannot be justified in the event of a tax audit.

Money Held in Trust

People operate bank accounts in trust for a multitude of reasons.

For instance: Mum and Dad in trust for child, or Son in trust for frail parent. Usually, bank accounts such as these are titled “mum as trustee for child†or similar. Such a title clearly indicates the trustee nature of the relationship.

When you operate a bank account as trustee for someone else, the money is theirs, not yours. Also, the interest earned on the account is theirs, not yours, and is declared in their tax return, not yours. When opening the account, the bank will ask to be given a tax file number and what they want is the TFN of the person whose money is being held in trust, not yours.

The ATO conducts data matching on the basis of names and TFNs. If you give the bank your own TFN you will eventually have the ATO suggesting, you have not disclosed and paid tax on the interest earned by the account for which you are merely acting as trustee. Make sure you give the bank the TFN of the person whose money it is.

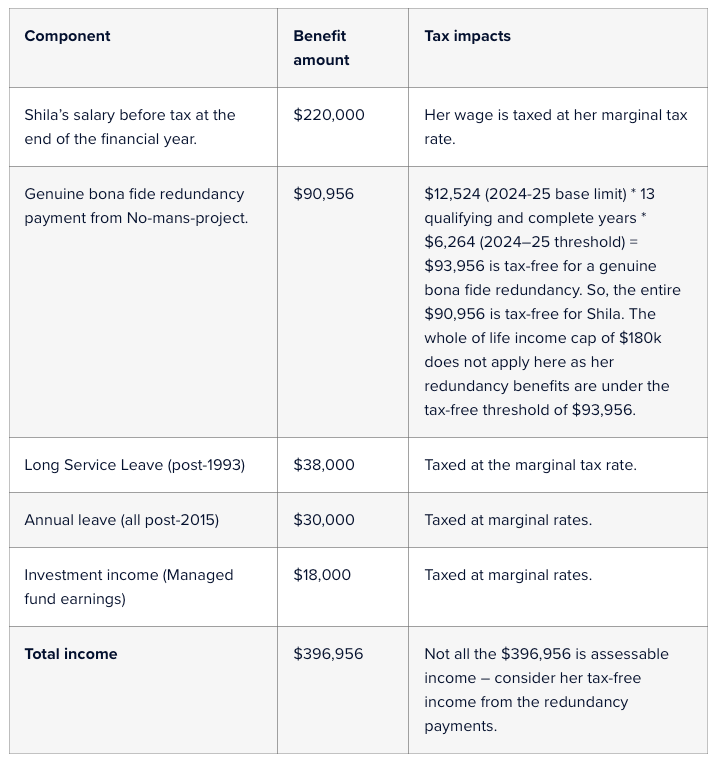

Redundancy and Early Retirement Payments

Bona Fide redundancy and approved early retirement payments up to an indexed threshold (2019 $10,399 plus $5,200 for each completed year of service) are tax deductible to the employer and tax free to the employee.

Bona fide redundancy occurs where an employer no longer requires an employee to carry out a particular form of work. Note the termination must be initiated by the employer and it must be the job that becomes redundant and not the employee.

Single Car Families and Motor Vehicles Expenses

Where a car is jointly owned a common error when claiming deductions is that couples assume because the car is already claimed by one person, expenses cannot be claimed by the second person. This is incorrect. This relates to the “cents per kilometre†claim for Motor Vehicle expenses.

Sickness and accident insurance payments

Premiums for sickness and accident cover (income protection type policies) are tax deductible. Due to the operation of the “otherwise deductible†rule, payments can be made by the employer without incurring Fringe Benefits Tax.

Salary packaging

Salary packaging can also assist in the minimisation of income tax, particularly in the areas of voluntary superannuation contributions, and acquisition of assets that are subject may be beneficial FBT treatment such as supply of a motor vehicle.

You should be aware that your employer is required to report the value of fringe benefits on your payment summary, to form part of your adjusted taxable income (ATI) and this may affect government and other payments you may receive or be entitled to.

Check with us to see if salary packing may be advantageous for you.

ATO Data Matching

The ATO receives transactional data from banks, companies, managed funds, state government departments, including interest, dividends, distributions from managed funds, details of land and property sales and purchases, motor vehicles, boat purchases. The ATO uses this data to confirm that proper disclosure has been made in income tax returns.

When gathering the information required to prepare your income tax return, be very careful to include details on all relevant transactions that have occurred during the financial year.

Reduce Capital Gains Tax (CGT)

If during the year you have realised a capital gain from an investment prior to 30 June, consider triggering a capital loss by selling a poorly performing investment than no longer suits your circumstances. This will allow you to use the capital loss to offset your capital gain and save tax. You will also have additional funds for more suitable investment opportunities.

Defer asset sales if you are about to sell a profitable asset late in the financial year, you may wish to defer the sale contract until after 30 June 2019. This defers the capital gains tax until May 2021 and there is also the possibility of reducing CGT.

Pay Staff Super

Pay your staff’s super for the 30 June Quarter prior to 30.06.2019 to get the tax deduction this financial year. This is one of the most effective ways of bringing forward expenditure.

Trust distributions

Trustees of discretionary and family trusts must make valid distribution resolutions before 30 June to effectively distribute trust income to eligible beneficiaries.

The resolution must be made in accordance with the Trust Deed.

As the ATO have started to actively monitor this, it is suggested that there is written evidence of the 2018/19 trustee determination of the net income of the trust – preferably in the form of a trustee resolution be prepared by 30 June 2019.

- Due to changes in the last federal budget, from 1.7.2019, trusts and companies cannot be used to declare this income earned via image or reputation. It must be declared in the individual’s name.

STP AND END OF FINANCIAL YEAR CHANGES

Single Touch Payroll (STP) has changed how employers provide, and how employees access, end of financial year information.

For employers who are reporting through STP:

- They are not required to provide payment summaries to their employees or lodge a payment summary annual report for information they report and finalise through STP.

- They should let their employees know:

- if they will not be providing them with a payment summary;

- income statements will replace payment summaries;

- their employees can access their income statements through ATO online via myGov at any time. They can only use this information to lodge their tax return when the income statement has a status of “tax readyâ€.

- If they started STP reporting in the 2018-19 financial year, they have until 31 July 2019 to make the finalisation declaration. Encourage your employer clients to finalise all employee records reported through STP as soon as they are ready. The sooner information is finalised, the sooner it will display as ‘tax ready’.

For employees:

- Income statements will replace payments summaries. Employees can access their income statements through ATO online via myGov. If they do not have a myGov account, they should create an account online ( https://my.gov.au/LoginServices/main/login?execution=e2s1 ) and link to the ATO.

- The ATO will also have access to client statements through Online services for agents – Lodgements then Client reports and the Tax Agent Portal.

In mid-May the ATO sent an email to employers reporting through STP to let them know about their end of tear reporting obligations.

If we can be of any assistance, please do not hesitate to contact us.

Please note: Our Newsletters are not the place for the giving or receiving of financial advice concerning investment decisions or tax or legal advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. Any ideas and strategies should never be used without first assessing your own personal needs and financial situation, or without consulting or engaging with us as your professional advisors.