EOFY 2023-2024

Ways to get ready for tax time

The end of the financial year on 30 June 2024 is fast approaching, so here’s a quick checklist to help you prepare in advance and maximise your tax time benefits.

Understand your sources of income

Income can come from all sorts of areas.

- Interest earned from bank accounts

- Dividends received from shares

- Employee share options

- Capital gains received from the sale of an asset

- Rental income from an investment property

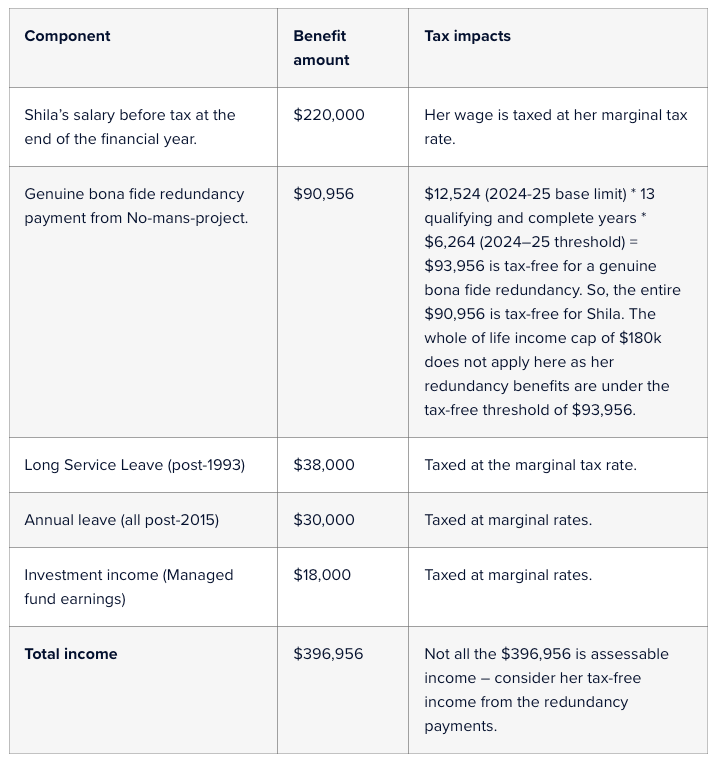

- Redundancy payments

- Any taxable Centrelink payments

Deductions

Undoubtedly, it is the most contentious area of tax returns. This could include expenses incurred and not reimbursed, which may reduce tax liability. Some common deductions are:

- Work-related expenses

- Home office expenses

- Self-education and professional development

- Registrations, subscriptions, memberships

- Vehicle and travel expenses

- Protective clothing, laundry and dry-cleaning expenses

- Tools and equipment, including depreciable assets (such as laptops)

- Accountant or tax agent fees

- Personal super contributions

- Investment income expenses

- Income protection insurance premiums

Offset capital gains against capital losses

Disposal of shares or any other form of investment may cause capital gain. You may consider disposing of any assets you know are trading at a loss. The resulting capital losses can be offset against the capital gain. Don’t forget the upcoming tax changes may mean that from 1 July, you’re paying less tax, which might affect when you decide to divest any investments and incur a capital gain – this year or next.

Also, be careful if you sell shares at a loss and buy them back in the new tax year. The ATO takes a hard line against so-called “wash sales”. This refers to the sale of an asset before the year-end and the purchase of a substantially identical asset immediately after the year-end. The ATO regard the purchase and the sale as effectively the same asset and has issued a Tax Ruling, which states that they can apply the anti-avoidance provisions to cancel any tax benefits and apply penalties.

Document your donations

It’s great to give to your charity of choice, but don’t forget your potential tax deductions. So, hang on to your receipts and record your donations. Ensure that the charity is a deductible gift recipient.

Understand the Medicare levy

If you earn over a certain amount, you must pay the 2% Medicare levy to help fund the private health system. But there’s a potential rebate available if you are a high income earner and take out private health insurance. So, you might want to work out your best approach, particularly if you have earned more than last year.

Get your retirement income right

If you’re retired, the good news is you can earn a higher income level before you start paying taxes. But it can depend on your age and the type of income you receive, so it’s a good idea to get across all the rules with your accountant.

Get your investment property affairs in order

If you’re renting a property out, you’ll probably be aware that there are plenty of tax deductions you can claim for things like depreciation, the cost of repair and maintenance, interest costs on your loan and fees that you pay for a real estate agent to manage your property. As usual, the rules can (and do) change, so check all the latest expenses you can claim here.

Home Office

If you are employed but work from home, occasionally or all the time, you are entitled to deductions for costs arising from working at home. The expenses that you can claim include:

- Heating, cooling and lighting

- Cleaning costs

- Decline in value (depreciation) of home office furniture and fittings, office equipment and computers (for items over $300)

- Computer consumables, stationery, telephone and internet costs

- Items of capital equipment (such as furniture, computers and associated hardware and software) which cost less than $300 can be written off in full immediately

With many retailers running End of Financial Year specials, any purchases you make now can be deducted from this year’s tax return, so from a cash flow point of view, you can minimise the time between purchase and tax deduction!

Alternatively, you can claim the ATO’s concessional 67 cents per hour fixed rate to include several working-from-home deductions in one simple, easy-to-use amount. The rate includes the additional running expenses you incur for:

- home and mobile internet or data expenses

- mobile and home phone usage expenses

- electricity and gas (energy expenses) for heating, cooling and lighting

- stationery and computer consumables, such as printer ink and paper.

To use the fixed rate, you must have kept a record of all your working from-home hours for the entire year (e.g., a diary, timesheets or rosters), and you must have one item of substantiation for each item claimed (e.g., a heating bill).

The fixed-rate does not include deductions for work-related use of technology and office furniture such as chairs, desks, computers, bookshelves or repairs to these items. Cleaning costs are also excluded. These costs can be claimed separately, so remember to keep those receipts.

Car expenses

If you use the log-book method, now is the time to check that your logbook is current and that you have all the receipts, invoices and journey records you need to calculate and substantiate your claim. Using the cents per kilometre method, you will still need a record of all work-related journeys during the year.

Mobile Phone

If you used your mobile phone for work purposes, you could claim a deduction for the business-related use. Ensure you have compiled your phone bills and have kept a log of your business/personal use over four weeks. That percentage can then be applied to the whole year.

It’s important to remember that you can’t claim a separate deduction for mobile phones if you have claimed the 67 cent/hour fixed rate for working from home.

Prepay expenses

You can claim a tax deduction this year for expenses which wholly or partly relate to next year. So, if you have some spare cash, consider paying things like union fees, professional subscriptions and annual insurance premiums in advance to accelerate the deduction.

If you have a geared asset like a rental property and have capital to inject, some lenders may allow you to prepay 12 months of interest on your investment loan. This will effectively bring forward your tax deduction into the current year and could help offset any capital gains or additional income you’ve earned.

Make a tax-deductible super contribution

If you have some spare cash, consider contributing to your super fund. Suppose your contributions (including those made on your behalf by your employer) do not exceed $27,500. Your cap may be higher if unused concessional contribution cap amounts are unused. This can be a great way to boost your retirement savings and claim a tax deduction for the personal contribution.

Co-contributions: Low or middle-income earners who make personal super contributions may receive a government co-contribution, up to a maximum of $500.

Employee salary sacrifice: an agreement with your employer to give up part of your salary (thereby reducing your taxable income) and invest it into super to boost your retirement savings.

Spouse contributions: A tax rebate (up to $540) may be available for after-tax contributions to super on behalf of a low-income spouse.

Timing: Contributions must be in your super account before 30 June, or they will count against the next financial year’s limits.

If you’re between 67-74, you won’t need to satisfy the ‘work test’ before making non-concessional contributions. However, you’ll still need to satisfy the work test requirement if you want to claim a tax deduction on your personal contribution.

The payment must be made by June 30th, and you must advise your super by providing a valid ‘notice of intent to claim a deduction for personal superannuation contributions’ to your super fund and have received written acknowledgement.

Small business Initiative during EOFY

Checklist of to-do before year-end

- Review year-to-date figures to determine likely tax liability

- Consider strategies for management of the likely tax position

- Determine dividends to be declared for companies

- Prepare distribution minutes for trusts

- Consider owners’ remuneration and optimise tax outcome

- Small Business Entities – cash vs. accruals/prepayments/depreciation

- Make superannuation payments as they are only deductible when paid

- Debtor analysis – consider bad debts/timing of invoicing

- Creditor analysis – bring forward expenses to get a tax deduction

- Stocktake – undertake a stock take and consider obsolete stock

- Plant and equipment – consider any new equipment needed and ensure it is available and ready for use before June 30

- Fringe Benefits Tax – if FBT return is not lodged, consider a private portion of expenses and GST adjustments

- Capital Gains Tax – consider the sale of any investments and prepare likely tax calculations

Asset write off

If so, look to utilise the “instant asset write-off” measure. Provided your business has a turnover of less than $10 million, this allows you to claim an immediate tax deduction for all capital purchases costing less than $20,000 rather than depreciating the cost over several years, as used to happen.

This is great for tech items such as computers, tablets and phones, as well as tools and equipment for tradies, office furniture and even motor vehicles (though any cars will probably need to be second-hand, given the $20,000 limit!).

Remember, besides purchasing, the asset you acquire must be used or available in your business. So, realistically, you need to get the item delivered and installed by 11:59 PM on 30 June 2024 to secure the tax deduction. If you order something now for delivery and installation in July, you won’t be able to claim the deduction this tax year. Note that the instant asset write measure will also be available in 2025.

Maximise your tax-deductible debt

Loans for private purposes are not tax deductible. Review whether refinance options may be available to split your deductible vs non-deductible debt. Determine whether loan repayments can be restructured, as the new rules limit the deductions available against vacant land.

Write off bad debts

If debtors are not recoverable after all action has been taken, write off the bad debt before June 30 to account for the expense. Ensure GST is adjusted.

Write off slow-moving or obsolete stock

Review your stock holding. If the market value is lower than the cost of the stock, you can obtain a deduction for the difference.

Utilise unrealised capital losses

Ensure you take advantage of capital losses within your group. Consider preparing distribution minutes that use group losses.

Check depreciation rates on plants and equipment

Review depreciation schedules for any scrapped plant and equipment that can be written off. Review the effective lives of equipment and consider whether you can increase the depreciation rate.

Check your access to refundable franking credits

Look for opportunities before June 30 to access any refundable franking credits. Consider whether any loss entities could result in a flow of highly franked income, resulting in a refund.

Claim eligible research and development activities

When engaged in research and development activities, clearly document the activities and costs relating to those activities to take advantage of R&D Tax Offsets.

Plan for your tax position before June 30

Understand your options to reduce or defer tax payments. Plan your cash flow for tax instalments and the tax due on tax return lodgements. Identify opportunities to vary tax instalments and improve cash flow. Implement the tax planning measures listed above, as well as other savings.

Other considerations

- Planning for one-off transactions – e.g. Business sales or purchases.

- Self-managed Super Fund (SMSF) – do you have an SMSF? Consider the impact on the business.

- Purchase of property or business premises.

- Consider the relevance of existing accounting systems and consider new technology.